How To Become a Quant PM

How to become a quantitative portfolio manager?

When I ask candidates “What are your career aspirations?”, naturally there are a huge variety of answers, depending on a range of factors. That said, for quant researchers, one of the most popular answers is that they wish to become a Portfolio Manager.

To be hired as a Portfolio Manager, you need a track record. Some clients ask for ten years track record, others ask for three to five, some just need a one-year track on a deployable strategy. With no track record, no group is going to give you client or even prop money to make bets on the financial markets with zero prior experience.

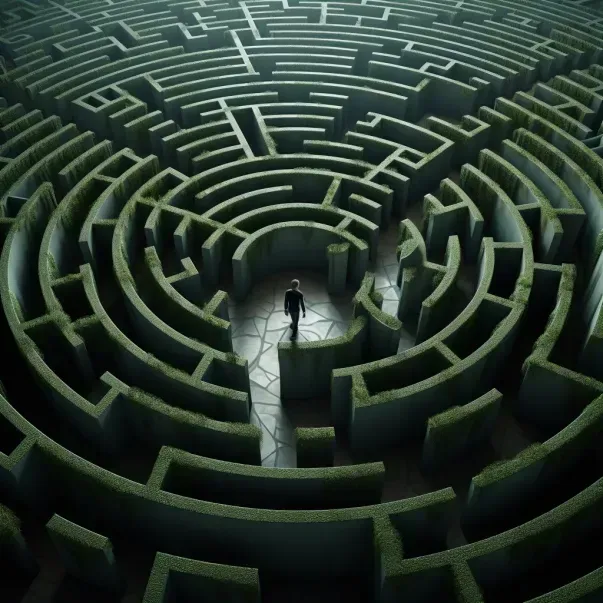

So how do you get a track record? Well, by being a Portfolio Manager…. Therein lies the problem: To be hired as a Portfolio Manager, you need a track record. To have a track record you need to be a Portfolio Manager.

The set-ups

To understand the journey to becoming a Quantitative Portfolio Manager, we must first understand the different set ups. While each group is uniquely different in their approach and set up, we can generalise on a basic level for quant funds that they are either a multi-manager platform, or a collaborative research environment.

On a multi-manager platform, you have a Portfolio Manager, possibly with a sub-PM and then quantitative researchers beneath. A PM will have researched and created a portfolio of strategies and will be in charge of how to allocate the risk within that portfolio and setting the research agenda for the researchers.

A Quantitative Researcher works under a PM with the focus typically on alpha signal generation; commonly improving the current signals, or if more senior, coming up with new ideas & signals.

A Sub-PM is typically a researcher who has proven themselves to produce consistent new alpha, so has been given a small amount of risk to manage themselves, under the direct and strict supervision of the PM – essentially, they will create the signal and then “monitor” the trades.

Collaborative Research groups are different in that they have large teams of researchers reporting to a head of desk/research. The teams are usually asset class specific and will cover alpha research and portfolio construction. The team will have a discussion around the risk that is put on to each signal/model, yet the actual trading will usually fall under a separate team, an execution team.

There is a third type of group to briefly mention that have Quantitative Traders, these are heavily associated with fully systematic funds that were prop desks spun out of the banks. Whilst Quant Trader can be a board term, in this context, a Quant Trader is similar to a sub-PM, rather than PM. Senior Management will have total responsibility for the whole portfolio and then divide that into sub-portfolios specific to a strategy style and allocate risk to that person in a strict sense.

Original ideas!

Some researchers only focus on improving the current signals, which means at best you’ve inherited a strategy. Sadly, a group is not going to hire you to only replicate another person’s work. Maybe in years gone by would groups hire you to take a strategy and gain insight into the competition. Today, where trades are already so crowded, they want someone with more creativity. When the signals decay, as they inevitably do, there is no proof you can adjust to the changing market conditions if you haven’t created anything new. If you’ve been involved in idea generation, then you have extra value.

Once you have a track record of new ideas that have been proven to generate returns, you can start to acquire more of the skills a PM requires. The two major skills in my opinion are portfolio construction and risk management.

Portfolio construction appears to be a skill that is learnable relatively quickly, mastery is the difficulty. However, for something like a cash equity stat-arb strategy, mastery is not required. It is likely best achieved in your current role by working with team members or shadowing the PM.

Risk management experience is a bit trickier to acquire. Here I am talking specifically about running risk, money, PnL management. At a minimum, monitoring of execution is a handy first step. Realistically, it’s far bigger than that, and given the automated execution world we live in, not that simple. The real thing is to be involved in the discussion around risk allocation to your signals and the weightings each model is given.

Risk management is most important around drawdowns and how you handle them. Drawdowns are a natural part of the process, and you need to understand the mathematics & economics of why it occurred, as well as know what to do in theory. In the real world, none of that prepares you for actually telling management that you lost $100k, $500k, or a million today. That is more about human psychology, and can really only be mastered through experience. If you can’t explain why a drawdown has occurred, your tenor will likely be short lived.

Now you have original ideas, you know how to bring them into one strategy, and you have a foundation in PnL management, you can then ask to be given responsibility for managing the risk around your research and so become a sub-PM.

The Researcher Trap

Do not fall in to the trap that some researchers do, where they create a great signal, and think they deserve to become a PM.

Just because you’ve created a signal out of some credit card data doesn’t mean it will last forever!

It will not be long before it’s arbitraged away when everyone else finds it. Numerous quality ideas, coupled with abilities to manage risk is what is required to become a PM, sub-PM or a Quant Trader.

Stepping up

So you’ve stepped up from a researcher to become sub-PM or a Quant Trader, but to continue the journey, you need to be asking some different questions.

If you’ve been a sub-PM for a year, then you have the making of a track record. You’ll be able to point to a PnL history and claim it as yours. Once you have this, then your current firm should be looking to make you an independent PM.

Firstly, you should be asking for more autonomy to put your own trades on. I find sub-PM’s are strictly managed and everything needs to be signed off by the PM. Achieving autonomy is a step in the right direction to becoming an independent PM.

Additionally, you need to be asking to scale up. In the majority of cases, the amount of risk you can put on is strictly managed. The top groups are not going to hire you if you have a 3-year track record, but have only been trading $10m GMV… they are in a different league. At an absolute minimum, you need $20m capital/AUM, un-leveraged. Realistically, you need $50/$100m in book size for the top tier groups to consider you.

Scale isn’t just an issue of capital, it’s also about how diversified your own strategy is. A great Sub/PM or Quant Trader is looking into new data sets, new academic research, new market intel etc. in order to scale the portfolio in a different manner.

You get a better Sharpe ratio from 1000 decent signals, than you do off 10 great ones!

So you need to be asking about bringing new research in, which I find can be a sticking point, particularly in the Quant Trader set-ups I mentioned which seem to have more internal secrecy - potentially a hangover from their banking days where secrecy was king in a highly political environment. The Quant Trader style shops can limit access to particular data sets, prevent you from running different style strategies, restrict you to specific markets or even exchanges. All of which severely hamper your ability to scale ideas.

One thing to consider is that each group has its own trading mandate, so any new research would need to be in line with that or a natural progression for the group. You are not going to be able to go from stat-arb US equities to looking at index-rebalance in APAC.

If you’re running risk on strategy ideas designed or thought up by someone else, and not bringing your own, then you’re more of an execution trader. Signals decay and, as with the researcher, funds want to know they can count on you to continue to deliver returns when they do decay by creating new signals, as well improving old ones. Showing this skill is extremely important to being given independent status.

Reality

A PM will offer their best researcher a sub-PM role because he or she doesn’t want to lose the alpha generated by that researcher. However, once you’re a sub-PM you can hit the glass ceiling quite quickly. You can have a great run for 2/3 years as a sub-PM, but it can be difficult to go on to the next level and gain independent PM status. Management are unlikely to want to fix what is not apparently broken. Also, the PM will not want to lose the nice percentage you add to their portfolio and their back pocket!

Next Steps

There are steps to be taken at each stage of your career in order to achieve the career aspirations you desire. Starting with the big picture of what kind of PM you would want to be, and working backwards from there to understand the skills required at each stage. Then making concerted efforts to learn them, and put them into practice. The most obvious place to begin with is in your current role, the majority of groups and PM’s will certainly help you grow. It’s when you’re prevented from learning & growing, when you hit that glass ceiling, stopped from scaling or limited by imagined walls, that’s when you should consider if there is a better group that can facilitate your career aspirations.